Okay, so if you’re a born-again believer, you’re probably joyfully envisioning Heaven, or are at least adding “if the Lord tarries” to the question. And if you’re not, you may be counting on moving in with your children or enjoying a living arrangement like the Golden Girls’ of 1980s TV fame.

But say none of these alternatives pans out, and you find yourself unable to live on your own. Will a decent nursing home be an option for you?

The truth is that only God knows for sure. If our economy crashes and the Huns

overrun our country, all bets are off. But let’s keep playing make believe and pretend that America will still be the Beautiful and we will still have some viable financial resources to work with. What’s likely to be available?

It turns out to be a disturbing question.

Consider this alarming statistic: “Approximately 70% of those currently 65 and over will need long-term care at some point,” according to the online information resource Carewindow, “for an average of 3 years.”

To get a sense of the potential magnitude of the need, take a look at a few statistics on the aging of America.

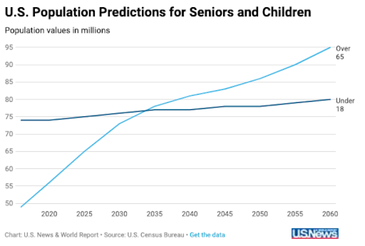

“The Census Bureau predicts that seniors will outnumber children by 2035,” U.S. News pointed out in a report entitled “Aging in America, in 5 Charts.” In fact, seniors already account for anywhere from 12% to 20% of the total population of these United States, the report said.

Who will support the aging population?

According to the Mercatus Center at George Mason University, by 2034, “The best-case scenario is 2.3 workers paying for each retiree, and in the worst-case scenario that ratio is 2 workers per retiree.”

And the news gets worse, because those numbers don't take into consideration the astronomical costs of skilled nursing care.

So we are seeing a dramatic growth in our nation’s elderly population, and therefore in the number of people who will need skilled nursing care, at the same time that there will be fewer workers-per-elder to pay for this care.

In the meantime, as demand for nursing-home beds increases, at least in some states, the supply is dwindling.

From what I’ve been told by Julie Ellis, Ph.D. RN, the situation is not getting any rosier here in Wisconsin. A geriatric clinical nurse specialist, nurse educator and researcher, Dr. Ellis said that the number of Wisconsin residents 65 and older is expected to grow by 72% between 2015 and 2040. Yet between 2016 and 2018, 19 nursing homes closed in our state; and in 2019 alone, 17 more permanently shut their doors. Over the past eight years, she said, we've lost more than 6,600 nursing home beds due to closure and downsizing.

Why is this happening? Here are some of the forces at work in Wisconsin, according to Dr. Ellis:

- Our state’s low Medicaid reimbursement rates, which cause Wisconsin nursing homes to lose money on patients forced to rely on government funding

- A state initiative to encourage more people to choose in-home or assisted-living options over nursing-home care – an unworkable solution for many

- A dramatic workforce shortage in the long-term-care industry

Let’s connect the dots. A burgeoning elderly population, most of whom will need long-term care for an average of three years, and an alarming decline in nursing home beds: the outlook seems pretty dire to me.

Clearly, something has to change. Let’s hope it’s not what’s happening in Europe, with the very elderly being shipped off to countries where care can be delivered far less expensively – nations in eastern Europe, for instance, or countries like Thailand.

What can you do to protect yourself over the long haul? God only knows. But at this point, maintaining some level of long-term-care insurance seems like a sensible option, if you can find something affordable. Otherwise, keep yourself as healthy as possible and pray that you and your loved ones will be among those who never need such care.

RSS Feed

RSS Feed